Property Acquisition by Foreigners in Turkey

Buying a property abroad may have seemed like a difficult process to foreigners because of the lack of knowledge and communication issues. Despite its intimidating procedures, purchasing process in Turkey is quite easy and secure. All the necessary procedures are focused on protecting the investment and investor’s interests. We prepared a list including important steps to guide you from purchasing process to finalizing the sales process.

The Purchasing Process for Buyers

• Title deed conveyance is protected by the land register system of the Turkish Government.

• Title deed conveyance is protected by the land register system of the Turkish Government.

Land Registry and Cadastre Directorate is the official responsible for the title deed conveyance process. Every transaction is registered and protected by the land register system to secure the seller’s and buyer’s rights.

• Foreign buyers can be exempted from VAT tax in certain conditions.

VAT tax is compulsory for Turkish citizens during the purchasing process. The VAT rate is determined as 20% by the Turkish Government. Although in some conditions, it can be applied as 1% and 8%. Foreigners can be exempted from this tax by certain situations such as;

• If the buyer does not reside in Turkey,

• If the payment of the purchase is provided by a source abroad,

• If the buyer will not sell the house at least for 1 year,

• The refund only applies to invoiced purchases from construction companies. If the property had been bought from an individual, the buyer must pay VAT Tax.

• Title deed fee is mandatory.

The title deed conveyance tax is determined as 4% in total. According to the law, 2% of the sales price will be provided by the buyer, the other 2% will be provided by the seller. This topic should be discussed before signing the sales contract. If you don’t negotiate on this subject before signing the contracts, it is expected that the buyer pays the title deed conveyance tax by tradition in Turkey.

• Tax ID number is obligatory.

Buyers should get a tax ID number to pursue legal transactions. It is related to any financial actions such as title deed conveyance, insurance, tax payments, water and electricity subscriptions, etc. Applications are taken by Tax Administration Office with your passport.

• Appraisal report is optional.

The appraisal report shows the actual value of the property. The evaluation of the property by experts prevents fraudulent methods during the purchasing process.

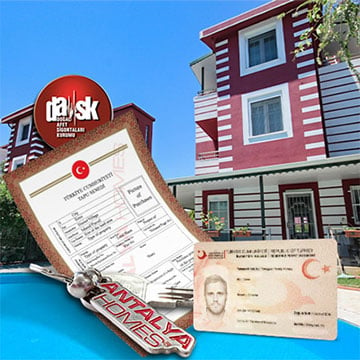

• DASK insurance is compulsory.

This insurance is designed to protect your property, its value, and any sudden expenses from any damage caused by one of the biggest natural disasters: Earthquakes. It is an important step of the purchasing process and can be combined with other insurance types such as theft, fire, hurricane, etc. Also, DASK insurance is compulsory to apply for utility subscriptions.

• Buying a property by a mortgage from Turkish banks is eligible.

You can purchase a property by mortgage in Turkey. Many banks in Turkey accept mortgage applications made by foreigners.

• The full payment will be made first.

Because of the secure land register system, your investment is protected by state-affiliated public institutions. To protect the seller’s interests, full payment will be made before the title deed conveyance.

The Selling Process

• Sales procedure is standard for buyers from any nationality.

• Sales procedure is standard for buyers from any nationality.

The procedure applies to any buyer of any nationality. There is no segregation according to the religions, languages, and nations.

• Title deed fee is mandatory for sellers either.

The title deed fee is determined as 4% in total. 2% of the sales price will be provided by the seller, the other 2% will be provided by the buyer. There might be some complications about this subject because of the traditional sales system in Turkey. It is expected that the buyer pays the title deed conveyance tax by tradition in Turkey. It should be determined with the seller before signing the sales contract.

• Income tax is applicable for sellers in certain situations.

Income tax is obligatory for sellers who have held the property for less than five years. If the seller owns the property for more than five years, income tax is not applicable.

Ownership

• Foreign property owners may apply for a residence permit.

Property ownership can be considered as a gateway to living in Turkey and become a Turkish citizen. Property owners have the right to apply for a residence permit with their title deeds.

• Foreign property owners have the right to apply for Turkish citizenship.

In certain conditions, Turkish citizenship is applicable to foreigners who own property in Turkey. There will be some conditions to apply such as;

• The property investment must be over 400.000 USD.

• The property will have a deed restriction because of the 3-year selling prohibition.

• Foreigners who have owned properties in Turkey and lived in Turkey continuously for five years, except for short-term travels, can also apply for Turkish citizenship. In this case, property price is not taken into consideration. The 400.000 USD investment condition is not stipulated for such applications.

• Ownership can be demised between generations of the same family.

The legal owner has all the rights of the property. Foreign heirs can request ownership by demising and become the legal owner.

• Property can be used as a profit source by renting.

There is no limit or restriction about making a profit from the property. Regardless of the property type, any real estate can be rented out. Many property owners make profits by renting out their properties.

• There is a limit on obtaining property by size in the country.

Foreigners cannot obtain a property of more than 30 hectares countrywide and more than 10% of the urban areas in the subject district. It can be increased by state authorities such as the President of the country.

• Foreign buyers may not acquire properties in military forbidden zones.

Related to national security concerns, foreigners cannot buy property situated in military forbidden zones.

• You are not liable for income tax if you do not rent your property or have an income from it.

If you decide to make a profit from your investment by renting or selling it, because of the income, you will be liable to pay an income tax.